Last year’s flooding in Lower Silesia resulted in billions of złoty in losses, with numerous properties experiencing severe destruction or becoming completely unusable. How did the insurance industry respond to this crisis? Did the disaster alter public perspectives on property coverage? Bankier.pl explored these questions in a recent analysis.

The September 2024 floods in Lower Silesia, especially in the Kłodzko Valley, impacted around 60,000 residents. Estimated damages reached billions of złoty, leaving many structures extensively harmed or beyond repair. The crisis prompted government aid for affected communities, while insurers faced a wave of property claims. Has this event influenced how Poles view home insurance in the following year?

Insurers mobilized rapidly

Per the Polish Insurance Chamber, the scale of the flood tested the sector’s organizational capacity, yet over 90% of claims were resolved by year-end 2024. The resolution process prioritized speed, with insurers streamlining procedures to address the high volume.

Advertisement See also Selected for you: 10% discount on school accident insurance, with code 02346

“This event underscored insurers’ commitment to policyholders during crises. The majority of cases saw swift closure, with 95% finalized by late 2024,” noted Artur Dziekański, spokesperson for the Polish Insurance Chamber.

Companies adopted expedited claim reviews, issuing upfront payments and advances to expedite recovery. By October 2024, over 42,000 individuals had received compensation, supported by mobile appraisal units and drone technology. Government aid complemented these efforts, offering financial relief and psychological services.

Billions in payouts and rising policy uptake

While coverage for fire and accidental damage continues to expand, the Polish Insurance Association attributes this trend more to economic development than heightened awareness. Mandatory policies for mortgaged properties drive much of this growth. Data from the KNF reveals surging demand, pushing gross premiums for household policies to nearly PLN 1.8 billion.

|

Element-related coverage in households |

|||

|---|---|---|---|

|

Q2 2023 |

Q2 2024 |

Q2 2025 |

|

|

Fire and accident policies issued |

5,611,298 |

5,933,251 |

6,202,330 |

|

Household sector premiums (PLN thousand) |

1,249,844 |

1,458,154 |

1,709,205 |

|

Source: Bankier.pl based on KNF data |

|||

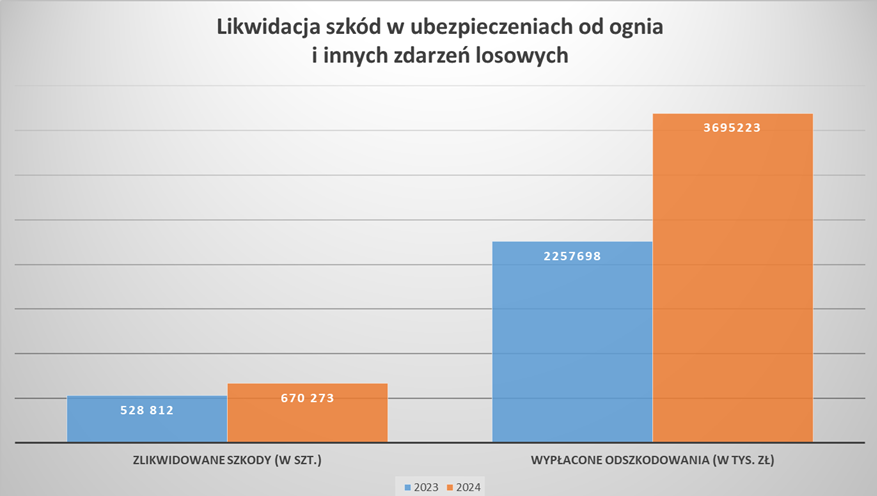

Natural disasters led to 670,000 claims in 2024, including 130,000 flood-related cases. Total payouts under fire and accident policies soared to PLN 3.7 billion—a 64% annual increase. Flood-specific compensation exceeded PLN 2 billion, highlighting the event’s financial impact.

Disputes over claim valuations

Despite efficient processing, some policyholders contested compensation amounts. The UOKiK and Financial Ombudsman reviewed cases involving allegedly reduced payouts and delays. Insurers occasionally denied claims by citing excluded perils, such as rainwater damage versus formal flood definitions. Labor cost calculations in estimates also sparked disputes, as they sometimes failed to reflect local post-disaster pricing.

Flood coverage: Available yet costly

Bankier.pl’s July findings indicate flood insurance remains niche, often requiring separate riders. While major insurers like PZU include it in standard packages, most treat it as an add-on. Premiums reflect risk assessments, with high-exposure areas facing steep costs.

“Insurers must align pricing with risk exposure, ensuring premiums cover potential payouts and administrative expenses,” clarified the Polish Insurance Chamber.

The Chamber highlights “uninsurable risks” where premiums outweigh practical benefits. To mitigate this, options like higher deductibles or coverage caps allow shared responsibility between insurers and clients.

Building national resilience

The Polish Insurance Chamber advocates for collaborative disaster frameworks, blending state and private efforts. Global models suggest solutions like catastrophe funds, mandatory coverage, or infrastructure investments to reduce vulnerability.

“Prevention through improved water management and risk-informed urban planning remains crucial,” added Dziekański. Insurers aim to enhance client communication, clarifying policy terms at every interaction stage.